Navigating the world of credit cards can be daunting. With so many offers, finding the best credit cards, especially those with zero interest, requires careful consideration. This guide helps you understand 0% APR credit card offers and how to choose the right one.

Understanding Zero Interest Offers

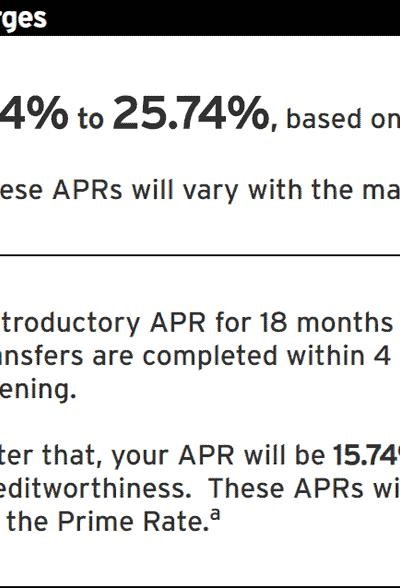

Many issuers offer no interest credit card deals, often advertised as interest-free credit card options or 0% APR credit card promotions. These are typically credit card introductory offers, often part of a promotional credit card strategy to attract new customers. They usually involve a period of low interest credit card rates, even 0%, for a limited time, after which a standard APR applies. These are frequently associated with balance transfer credit card options, allowing you to move high-interest debt to a lower-rate card.

Finding the Right Deal

Before applying, compare offers. Utilize online credit card comparison tools to find cheap credit cards with the best terms. Consider factors beyond the introductory 0% APR. Pay attention to the promotional period’s length, the APR after the introductory period, annual fees (if any), and any balance transfer fees.

Key Considerations:

- Promotional Period: How long does the 0% APR last?

- Post-Promotional APR: What’s the interest rate after the promotional period ends?

- Fees: Are there annual fees or balance transfer fees?

- Credit Card Eligibility: Your credit score and credit utilization significantly impact your eligibility for these offers.

The Application Process

Once you’ve identified a suitable card, proceed with the credit card application. Be prepared to provide personal information and financial details. Remember that your credit score and responsible credit management (low credit utilization) are crucial for approval.

Cautions and Conclusion

While 0% APR cards offer significant savings, they require careful planning. Failing to pay off the balance before the promotional period ends will lead to accumulating interest at the higher standard APR. Use the introductory period strategically to reduce or eliminate your debt. A responsible approach to credit card deals, including careful credit card comparison, will maximize the benefits of these offers. Remember to always check your credit card eligibility before applying.

Beyond the Introductory Offer: Long-Term Credit Card Strategy

Securing a 0% APR credit card, or even a low interest credit card, is a valuable tool for debt management, but it’s crucial to view it as a stepping stone, not a permanent solution. The allure of an interest-free credit card or a promotional credit card with a tempting credit card introductory offer shouldn’t overshadow the need for a long-term credit strategy. While using a balance transfer credit card to consolidate high-interest debt can significantly reduce your monthly payments, the focus should always remain on becoming debt-free.

Smart Usage of 0% APR Periods

The duration of the 0% APR period is critical. Carefully calculate how much you need to pay each month to eliminate the balance entirely before the promotional period ends. Overestimating your repayment capacity can lead to a sharp increase in interest charges once the standard APR kicks in. Consider creating a detailed repayment plan, factoring in any fees associated with the credit card application or balance transfers. Failing to adhere to this plan negates the benefits of securing a cheap credit cards with a seemingly attractive credit card deals.

Maintaining Good Credit Habits

Using a 0% APR credit card effectively contributes positively to your credit score. Consistent on-time payments demonstrate responsible credit management, improving your credit utilization ratio. A lower credit utilization (the amount of credit used compared to your total available credit) is a key factor in maintaining a healthy credit score. This, in turn, improves your credit card eligibility for better offers in the future. Avoid applying for numerous credit cards simultaneously, as this can negatively impact your score. Diligent credit card comparison, focusing on long-term financial health, should guide your credit card application choices.

Beyond the Zero: Choosing the Right Credit Card Long Term

While the appeal of a no interest credit card is undeniable for short-term debt consolidation, consider the long-term implications. Once the promotional period ends, the standard APR will become your ongoing interest rate. Therefore, after utilizing the 0% APR credit card effectively, shift your focus to finding a low interest credit card with rewards that align with your spending habits or a card with a low, consistent APR. Regularly review your credit card deals and conduct credit card comparison to ensure your card continues to meet your needs and financial goals. Remember, responsible credit management is far more important than chasing the lowest introductory rate.

0% APR credit cards, while attractive, require a proactive and informed approach. By understanding the terms, creating a realistic repayment plan, and maintaining responsible credit habits, you can leverage these credit card deals to improve your financial situation. Remember to always prioritize long-term financial health over short-term gains. Regularly monitor your credit score and credit utilization to maintain good credit standing. This will ensure you have access to the best credit cards and the best financial opportunities in the future.

A well-structured and informative piece. The step-by-step approach, from understanding the offers to the application process, makes the information easily digestible. The inclusion of cautions and a concluding summary reinforces the importance of responsible credit card usage and planning. This guide is a valuable resource for anyone looking to leverage 0% APR credit cards effectively.

This is an excellent guide for navigating the often-confusing world of 0% APR credit cards. The article clearly explains the key terms and considerations, such as the promotional period, post-promotional APR, and associated fees. The emphasis on comparing offers and understanding credit eligibility is particularly helpful and prevents readers from making potentially costly mistakes.