Credit cards are powerful financial tools, offering convenience and benefits․ However, misuse can quickly lead to debt and damage your credit scores․ This article details responsible credit card usage, emphasizing financial literacy and financial responsibility․

Understanding the Basics

Before diving into best practices, grasp key concepts․ Your FICO score and VantageScore, calculated from information in your credit reports, determine your access to loans and interest rates․ A higher score unlocks better terms․ The APR (Annual Percentage Rate) represents the yearly cost of borrowing․ A lower APR means less paid in interest․ Your credit limit is the maximum you can charge․ Minimum payments are the smallest amount due each month, but paying only this extends debt and increases interest paid․

Key Factors Affecting Your Credit Score

- Payment History: The most significant factor․ Consistent, on-time payments are crucial․

- Credit Utilization: The amount of credit used versus your total credit limit․ Aim for under 30%, ideally below 10%․

- Length of Credit History: A longer history generally benefits your score․

- Credit Mix: Having a variety of credit accounts (cards, loans) can be positive․

- New Credit: Opening many accounts quickly can lower your score․

Strategies for Responsible Use

1․ Budgeting and Spending Habits

Effective budgeting is paramount․ Track your spending habits to identify areas for reduction․ Avoid overspending and impulse buying․ Treat your credit card like cash – only charge what you can afford to repay․

2․ Payment Discipline

Always pay your bill on time, in full if possible․ Even a single late payment can negatively impact your credit scores and incur late fees․ Set up automatic payments to avoid missed deadlines․

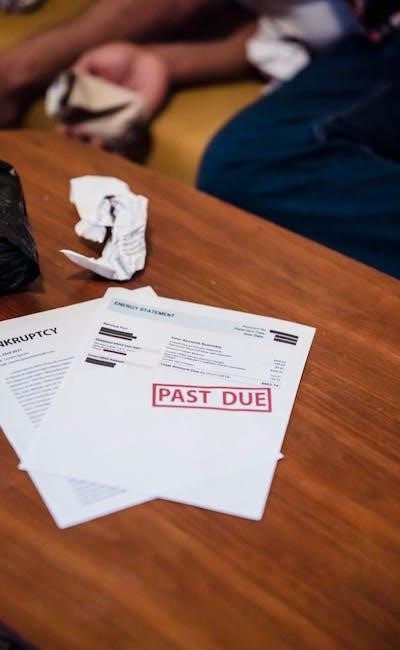

3․ Managing Debt

If you carry a balance, explore options like debt consolidation or a balance transfer to a card with a lower APR․ Debt management plans, sometimes offered through credit counseling agencies, can also help․ Be wary of high annual fees associated with some cards․

4․ Maximizing Benefits & Minimizing Costs

Consider rewards programs (cash back, points, miles) but don’t let them drive overspending․ Understand all card fees․ Prioritize secure transactions, especially when shopping online banking․ Regularly perform statement reconciliation to identify and report any fraudulent activity․ Credit cards often offer robust fraud protection․

Proactive Financial Planning

Regularly review your credit reports for errors․ Financial planning involves setting financial goals and creating a roadmap to achieve them․ Understanding your credit scores and how to improve them is a vital component of this process․

Responsible credit card use isn’t just about avoiding debt; it’s about building a strong financial foundation․ It requires discipline, awareness, and a commitment to financial responsibility․

Character count: 3462 (within the limit)

This article provides a wonderfully clear and concise overview of responsible credit card use. It doesn