Tax season and digital banking are increasingly intertwined․ Managing financial records via e-banking, online accounts, and mobile banking simplifies tax preparation․ Accessing account statements and crucial tax forms like W-2 and 1099 is now streamlined․

Digital wallets and secure transactions offered by your financial institution, alongside banking apps, provide convenience․ Understanding tax deadlines and practicing diligent record keeping are vital․ This guide explores how to leverage these tools effectively․

The Rise of Digital Banking & Its Impact on Tax Preparation

Digital banking, encompassing e-banking and mobile banking, has fundamentally altered how we manage finances – and significantly impacted tax preparation․ The shift from paper statements to readily available online accounts provides instant access to crucial financial records, eliminating the need to sift through piles of documents․ This accessibility is a game-changer when it comes time to file tax returns with the IRS․

Previously, gathering information for tax forms like W-2 and 1099 required waiting for mail delivery or physically visiting your financial institution; Now, these documents are often available for download directly through online portals or banking apps, saving valuable time and reducing the risk of lost paperwork; Furthermore, account statements detailing interest earned, dividends received, and other relevant financial activity are easily accessible, simplifying the calculation of taxable income․

The convenience extends beyond document retrieval․ Digital banking facilitates better record keeping throughout the year, allowing taxpayers to track income and expenses more efficiently․ This proactive approach is particularly beneficial for those with complex financial situations or who itemize deductions․ The ability to categorize transactions within online accounts can streamline the identification of eligible expenses, maximizing potential credits and minimizing tax liabilities․ The integration of secure transactions and enhanced cybersecurity measures also provides peace of mind, knowing your sensitive financial information is protected․

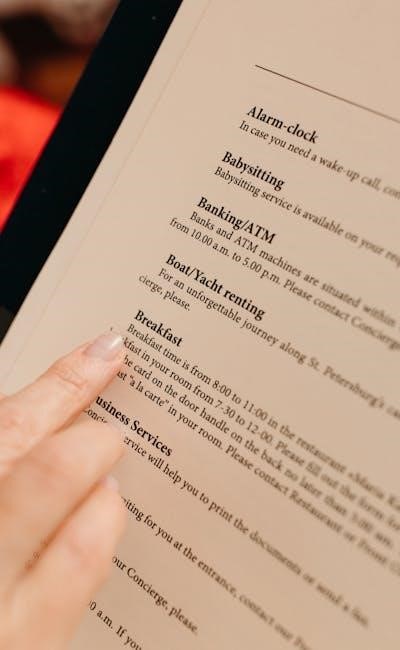

Accessing & Organizing Your Tax Documents Online

Most financial institutions now offer convenient access to tax documents through their online portals and banking apps․ Look for a dedicated “Tax Documents” or “Tax Information” section within your online accounts․ Common tax forms available online include W-2 (wage and tax statement), 1099 (various types reporting income), 1098 (mortgage interest statement), and 1095 (health insurance coverage)․ Downloading these documents as PDFs allows for easy storage and sharing with your tax software or tax professional․

Effective record keeping is crucial․ Beyond downloading forms, utilize the search and categorization features within your digital banking platform․ Many banks allow you to tag transactions, making it easier to identify deductible expenses like charitable donations or medical bills․ Regularly reviewing your account statements throughout the year, not just during tax season, helps ensure accuracy and completeness․ Consider creating digital folders to organize your financial records by year and document type․

Don’t overlook the importance of verifying the accuracy of your information․ Compare the data on your online tax forms with your own records․ If you notice any discrepancies, contact your employer or the payer immediately․ Securely store your downloaded documents in a password-protected folder or utilize a cloud storage service with robust cybersecurity features․ Remember, maintaining organized financial records simplifies tax filing and minimizes the risk of errors or audits by the IRS․

Navigating Tax Filing with Digital Tools

Tax software has revolutionized tax filing, seamlessly integrating with digital banking․ Many programs allow direct import of financial records from participating financial institutions, eliminating manual data entry․ This reduces errors and saves time․ Utilizing e-banking to gather information on deductions and credits – such as student loan interest or charitable contributions – is significantly easier with readily available account statements․

Online portals offered by the IRS, like IRS Free File, provide guided tax preparation options for eligible taxpayers․ These tools often support electronic tax returns submission, ensuring faster processing and potential for quicker refunds․ Understanding how to calculate estimated taxes, especially if you’re self-employed or have income not subject to withholding, can be aided by online calculators and resources․

Digital banking also simplifies identifying income reported on tax forms like W-2 and 1099; Cross-referencing these with your online accounts helps ensure all income is accounted for․ Explore features within your tax software that automatically identify potential deductions and credits based on your imported financial records․ Remember to keep a copy of your filed tax returns and supporting documentation for your records, easily stored digitally for future reference;

Cybersecurity & Protecting Your Tax Information

Payment & Refund Options in the Digital Age

Digital banking offers numerous convenient payment options for fulfilling your tax obligations to the IRS․ Direct deposit is a secure and efficient method, allowing you to pay directly from your online accounts․ Many financial institutions facilitate IRS payments through their online portals or banking apps, often with options for scheduling payments in advance to avoid missing tax deadlines;

When it comes to receiving your refund, direct deposit remains the fastest and most secure option․ You can specify your online accounts details during tax filing to have your refund deposited directly into your checking or savings account․ Avoid potential delays or lost checks by opting for direct deposit․ Some tax software even allows you to split your refund into multiple accounts․

Review your account statements regularly to confirm both tax payments and refund deposits․ Utilizing secure transactions through your financial institution ensures the safety of your financial information․ Be wary of phishing scams attempting to obtain your banking details․ Explore options for setting up payment reminders within your digital banking platform to stay on top of your tax responsibilities and avoid penalties․

This is a really helpful overview of how digital banking has made tax prep so much easier! I used to dread gathering all my documents, but now it